Developmental and Epileptic Encephalopathies Market to Observe Stunning Growth During the Study Period (2020–2034) | DelveInsight

The treatment paradigm for DEE is expected to evolve in the coming years. The DEE market size is anticipated to increase due to approved medications like EPIDIOLEX, which is expected to be a blockbuster, rising demand for novel treatments for other DEE subtypes beyond Dravet Syndrome, LGS, TSC, and CDLK-5, and the introduction of potential emerging therapies. In the larger DEE market, there are further opportunities for off-label use and label expansion in addition to Dravet Syndrome, LGS, TSC, and CDLK-5. However, the discontinuation of emerging therapies owing to either business decisions or a lack of efficacy evidence may impede this growth. This indicates that the DEE market is difficult to penetrate.

/EIN News/ -- New York, USA, April 08, 2025 (GLOBE NEWSWIRE) -- Developmental and Epileptic Encephalopathies Market to Observe Stunning Growth During the Study Period (2020–2034) | DelveInsight

The treatment paradigm for DEE is expected to evolve in the coming years. The DEE market size is anticipated to increase due to approved medications like EPIDIOLEX, which is expected to be a blockbuster, rising demand for novel treatments for other DEE subtypes beyond Dravet Syndrome, LGS, TSC, and CDLK-5, and the introduction of potential emerging therapies. In the larger DEE market, there are further opportunities for off-label use and label expansion in addition to Dravet Syndrome, LGS, TSC, and CDLK-5. However, the discontinuation of emerging therapies owing to either business decisions or a lack of efficacy evidence may impede this growth. This indicates that the DEE market is difficult to penetrate.

DelveInsight’s Developmental and Epileptic Encephalopathies Market Insights report includes a comprehensive understanding of current treatment practices, emerging DEE drugs, market share of individual therapies, and current and forecasted DEE market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Developmental and Epileptic Encephalopathies Market Report

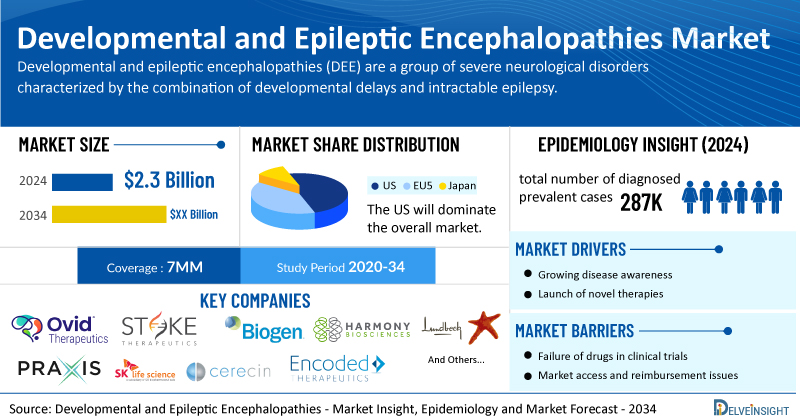

- According to DelveInsight’s analysis, the market size of DEE in the 7MM was USD 2.3 billion in 2024.

- In 2024, the US accounted for the maximum share of the total market in the 7MM, i.e., approximately 80%.

- The total number of diagnosed prevalent cases of DEE in the 7MM was nearly 287K cases in 2024 and are projected to increase by 2034.

- While there are some approved therapies for a few DEE subtypes, including Dravet syndrome and Lennox- Gastaut Syndrome (LGS), most subtypes have no proven treatment, and patients often have to take multiple medicines to try to keep seizures under control, with a high side-effect burden. Several companies working in the domain of DEE, including Ovid Therapeutics, Stoke Therapeutics, Biogen, Harmony Biosciences, Lundbeck (Longboard Pharmaceuticals), Praxis Precision Medicines, SK Life Science, Cerecin Neurosciences, Encoded Therapeutics, Praxis Precision Medicines, and others, are actively working on innovative DEE drugs. These novel DEE therapies are anticipated to enter the DEE market in the forecast period and are expected to change the market.

- Some of the key DEE treatments include Zorevunersen (STK-001), EPX-100 (Clemizole Hydrochloride), Bexicaserin (LP352), Relutrigine (PRAX-562), Carisbamate (YKP509), Tricaprilin (CER-0001), ETX101, Elsunersen (PRAX-222), OV329, and others.

- In February 2025, NICE approved FINTEPLA (fenfluramine) for people with Lennox- Gastaut Syndrome (LGS). It is the first licensed non-cannabis medication for this type of epilepsy. Prior to its approval in 2019, the only treatment for LGS that NICE recommended was EPIDYOLEX (cannabidiol) combined with clobazam. This is the second indication for which the NHS will provide FINTEPLA. Since 2022, the NHS has commissioned FINTEPLA to treat people with Dravet syndrome.

- In February 2025, Immedica Pharma AB announced the successful completion of the previously announced transaction to acquire all of the outstanding shares of Marinus Pharmaceuticals. Through this transaction, Immedica acquires Marinus' FDA-approved seizure medication ZTALMY.

- Zorevunersen, a first-in-class disease-modifying medication, will be made available to Dravet patients in all countries outside of the US, Canada, and Mexico thanks to a partnership between Stoke Therapeutics and Biogen in February 2025. Following successful alignment with regulatory agencies in the United States, Europe, and Japan, Stoke Therapeutics recently announced plans to initiate a global Phase III registrational trial of zorevunersen (EMPEROR). Commencement of the study is scheduled for the second quarter of 2025, and a pivotal data readout is planned in the second half of 2027 to support global regulatory filings.

- In January 2025, Takeda made the announcement to end the soticlestat development program. This decision comes after it was revealed in June 2024 that the soticlestat Phase III SKYLINE study in Dravet syndrome and SKYWAY study in LGS failed to meet their primary endpoints. Takeda therefore, stopped working on the soticlestat LGS development program and consulted with the US FDA over the overall data supporting soticlestat treatment for Dravet syndrome. The FDA notified Takeda that, to support a New Drug Application (NDA) for soticlestat in Dravet syndrome, the existing clinical data package would not be able to provide significant evidence of efficacy.

- In December 2024, Orion Corporation and Marinus Pharmaceuticals decided to mutually terminate their European-wide marketing and distribution agreement for ZTALMY. In Europe, ZTALMY is approved for the adjunctive treatment of epileptic seizures associated with cyclin-dependent kinase-like 5 (CDKL5) deficiency disorder (CDD) in patients two to 17 years of age.

- In November 2024, Eisai stopped the clinical development of the obesity drug lorcaserin in Dravet syndrome due to recruitment challenges (the decision was not due to any safety or efficacy reasons), which was further exacerbated by increasing competition (the availability of FINTEPLA).

- In December 2024, Lundbeck acquired Longboard Pharmaceuticals for USD 2.6 billion. With the completion of the acquisition, Longboard is now a wholly owned subsidiary of Lundbeck.

- In April 2024, Harmony Biosciences announced the acquisition of Epygenix Therapeutics, accelerating its growth strategy by adding a rare epilepsy franchise to its expanding late-stage pipeline of innovative CNS assets. The acquisition included clemizole hydrochloride (EPX-100), a potent, oral, centrally acting serotonin (5HT2) agonist currently in a pivotal registrational clinical trial for the treatment of Dravet syndrome in children and adults and poised to enter Phase III for the treatment of LGS.

Discover which therapies are expected to grab the DEE market share @ Developmental and Epileptic Encephalopathies Market Report

Developmental and Epileptic Encephalopathies Overview

Developmental and epileptic encephalopathies (DEE) are a group of severe neurological disorders characterized by the combination of developmental delays and intractable epilepsy. These conditions often manifest early in life and are associated with significant cognitive impairment. The causes of DEE can be diverse, including genetic mutations, structural brain abnormalities, metabolic disorders, and prenatal insults such as infections or exposure to toxins.

Common DEE symptoms include recurrent seizures, developmental regression, and cognitive impairments, which may vary widely among affected individuals. Diagnosis typically involves a combination of clinical evaluations, electroencephalography (EEG) to monitor seizure activity, neuroimaging techniques such as MRI, and genetic testing to identify underlying causes. Early recognition and intervention are crucial for managing symptoms and improving the quality of life in affected individuals.

Developmental and Epileptic Encephalopathies Epidemiology Segmentation

The DEE epidemiology section provides insights into the historical and current DEE patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The DEE market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalent Cases of DEE

- DEE Cases by Subtypes

Download the report to understand which factors are driving DEE epidemiology trends @ Developmental and Epileptic Encephalopathies Epidemiological Insights

Developmental and Epileptic Encephalopathies Treatment Market

The most commonly utilized treatment for epilepsy is antiepileptic drugs (AEDs). For nearly all patients experiencing multiple seizures, AEDs are the initial treatment choice. These medications effectively address the symptoms of epilepsy and successfully control seizures in about 70% of cases. They work by diminishing the brain cells' propensity to transmit excessive and erratic electrical signals, thereby preventing seizures.

The selection of medication is influenced by various factors, including the specific type of seizure and epilepsy, potential side effects, other medical conditions the patient may have, possible interactions with other medications, as well as the patient's age, gender, and the cost of the drug. Anticonvulsant therapy is also considered after a patient has two unprovoked seizures. The physician may prescribe either a single medication (monotherapy) or a combination of two or more medications as part of the treatment.

Valproate is regarded as the primary treatment for LGS due to its effectiveness against various types of seizures. It is typically used alone, but if it does not produce the desired results, additional medications like lamotrigine, topiramate, rufinamide, or clobazam can be introduced. However, it is important to note that valproate can cause notable side effects, including tremors, decreased platelet count and function, and hyperammonemia.

The US FDA has approved several drugs for the treatment of LGS and Dravet Syndrome, including different classes such as Sodium Channel Modulators, Gamma-Aminobutyric Acid (GABA) Receptor Modulator, Calcium Channel Blockers, Receptor Blockers, and a few other categories. Several AEDs currently available in the market consist of FINTEPLA, EPIDIOLEX, TOPAMAX, BANZEL, LAMICTAL, FELBATOL, ONFI, KLONOPIN, DIACOMIT, SABRIL, and others.

Learn more about the market of DEE @ Developmental and Epileptic Encephalopathies Treatment

Developmental and Epileptic Encephalopathies Emerging Drugs and Companies

Some of the drugs in the pipeline include EPX-100 (Harmony Biosciences), Bexicaserin (Lundbeck), Zorevunersen (Stoke Therapeutics/Biogen), Relutrigine (Praxis Precision Medicines) and others.

Harmony Biosciences’ EPX-100 is the most advanced 5HT2 (serotonin) agonist in the company's clinical development. EPX-100, clemizole hydrochloride, is under development for the treatment of Dravet syndrome and LGS. Harmony Biosciences has initiated a pivotal phase III study in LGS for EPX-100 in Q4 2024.

Bexicaserin (LP352) is an oral medication that acts centrally as a superagonist of the 5-HT2C receptor and is currently being developed for the potential treatment of seizures linked to DEEs, including conditions like Dravet syndrome, LGS, tuberous sclerosis complex, and CDKL5 deficiency disorder. The drug is designed to influence GABA levels, thereby reducing the central hyperexcitability typical of seizures. The DEEp SEA study, a phase III study, was initiated by Longboard Pharma in 2024 to investigate Bexicaserin for the treatment of Dravet syndrome.

The other pipeline therapies for DEE include

- Relutrigine (PRAX-562): Praxis Precision Medicines

- Elsunersen (PRAX-222): Praxis Precision Medicines

- Bexicaserin (LP352): Lundbeck

- Carisbamate (YKP509): SK Life Science

- Tricaprilin (CER-0001): Cerecin Neurosciences

- ETX101: Encoded Therapeutics

The anticipated launch of these emerging therapies are poised to transform the DEE market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the DEE market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about DEE clinical trials, visit @ Developmental and Epileptic Encephalopathies Treatment Drugs

Developmental and Epileptic Encephalopathies Market Dynamics

The DEE market dynamics are anticipated to change in the coming years. DEE is a group of rare conditions that presents significant opportunities for companies developing treatment options, as they can benefit from advantages such as 7-year market exclusivity in the United States, Orphan Drug designation, premium pricing, subsidies for conducting trials, various governmental R&D benefits, and additional perks; in the European Union, orphan classification offers protocol support, lower regulatory fees, and 10 years of market exclusivity, while the current competitive landscape for DEE is limited to a few therapies, making it an unexplored area for pharmaceutical companies with substantial potential to capture market space.

Furthermore, many potential therapies are being investigated for the treatment of DEE, and it is safe to predict that the treatment space will significantly impact the DEE market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the DEE market in the 7MM.

However, several factors may impede the growth of the DEE market. Currently, anti-seizure drugs are the standard of care for drug-resistant epilepsies; however, they only treat the symptoms without addressing the underlying causes of the disease, and there are no approved therapies for the majority of DEE types, with off-label options often resulting in poor outcomes, safety concerns, and tolerability issues; additionally, pharmaceutical companies face challenges such as designing and conducting clinical trials for heterogeneous patient populations, difficulties in patient recruitment, onboarding specialist doctors, and high attrition rates of experimental treatments during the R&D process.

Moreover, DEE treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the DEE market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the lack of awareness about the disease may also impact the DEE market growth.

Several medications have been discontinued in the last one to two years, either as a result of business decisions or a lack of efficacious data. This indicates that the DEE market is difficult to penetrate.

| Developmental and Epileptic Encephalopathies Report Metrics | Details |

| Study Period | 2020–2034 |

| Developmental and Epileptic Encephalopathies Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Developmental and Epileptic Encephalopathies Market Size in 2024 | USD 2.3 Billion |

| Key Developmental and Epileptic Encephalopathies Companies | Immedica Pharma AB (Marinus Pharmaceuticals), UCB BIOSCIENCES, Jazz Pharmaceuticals, Novartis, Ovid Therapeutics, Stoke Therapeutics, Harmony Biosciences, Lundbeck (Longboard Pharmaceuticals), Praxis Precision Medicines, SK Life Science, Cerecin Neurosciences, Encoded Therapeutics, and others |

| Key Developmental and Epileptic Encephalopathies Therapies | FINTEPLA, EPIDIOLEX, ZTALMY, AFINITOR/VOTUBIA, Zorevunersen (STK-001), EPX-100 (Clemizole Hydrochloride), Bexicaserin (LP352), Relutrigine (PRAX-562), OV329, Carisbamate (YKP509), Tricaprilin (CER-0001), ETX101, Elsunersen (PRAX-222), and others |

Scope of the Developmental and Epileptic Encephalopathies Market Report

- Developmental and Epileptic Encephalopathies Therapeutic Assessment: Developmental and Epileptic Encephalopathies current marketed and emerging therapies

- Developmental and Epileptic Encephalopathies Market Dynamics: Conjoint Analysis of Emerging Developmental and Epileptic Encephalopathies Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Developmental and Epileptic Encephalopathies Market Access and Reimbursement

Discover more about DEE drugs in development @ Developmental and Epileptic Encephalopathies Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Executive Summary |

| 4 | DEE Market Overview at a Glance |

| 4.1 | Market Share by Therapies (%) Distribution of DEE in 2020 in the 7MM |

| 4.2 | Market Share by Therapies (%) Distribution of DEE in 2034 in the 7MM |

| 5 | Key Events |

| 6 | Epidemiology and Market Methodology |

| 7 | Disease Background and Overview |

| 7.1 | Sign and Symptoms |

| 7.2 | Cause |

| 7.3 | Types |

| 7.4 | Diagnosis |

| 8 | Treatment of DEE |

| 8.1 | Antiseizure medications |

| 8.2 | Steroid therapy |

| 8.3 | Other Therapies |

| 8.4 | Epilepsy surgery |

| 8.5 | Treatment Algorithm |

| 8.6 | Treatment Guidelines |

| 8.6.1 | National Institute for Health and Care Excellence Guidelines |

| 8.6.2 | Practice Guideline Update: Efficacy and Tolerability of New AEDs 1st: Treatment of New-onset Epilepsy |

| 8.6.3 | Practice Guideline Update: Efficacy and Tolerability of the New AEDs 2nd: Treatment-resistant Epilepsy |

| 8.6.4 | Japanese Society of Neurology Guidelines |

| 9 | Epidemiology and Patient Population |

| 9.1 | Key Findings |

| 9.2 | Assumptions and Rationale |

| 9.3 | Total Diagnosed Prevalent Cases of DEE in the 7MM |

| 9.4 | Total Diagnosed Prevalent Cases of DEE by Types in the 7MM |

| 9.5 | The United States |

| 9.5.1 | Total Diagnosed Prevalent Cases of DEE by Types in the United States |

| 9.6 | EU4 and the UK |

| 9.6.1 | Total Diagnosed Prevalent Cases of DEE by Types in EU4 and the UK |

| 9.7 | Japan |

| 9.7.1 | Total Diagnosed Prevalent Cases of DEE by Types in Japan |

| 10 | Patient Journey |

| 11 | Marketed Drugs |

| 11.1 | Key Competitor |

| 11.2 | EPIDIOLEX (cannabidiol): Jazz Pharmaceuticals |

| 11.2.1 | Product Description |

| 11.2.2 | Regulatory Milestones |

| 11.2.3 | Other Developmental Activities |

| 11.2.4 | Current Pipeline Activity |

| 11.2.4.1 | Clinical Trials Information |

| 11.2.5 | Safety and Efficacy |

| 11.3 | FINTEPLA (fenfluramine): UCB |

| 11.3.1 | Product Description |

| 11.3.2 | Regulatory Milestone |

| 11.3.3 | Other Developmental Activities |

| 11.3.4 | Current Pipeline Activity |

| 11.3.4.1 | Clinical Trials Information |

| 11.3.5 | Safety and Efficacy |

| 11.4 | ZTALMY (ganaxolone): Immedica Pharma AB (Marinus Pharmaceuticals) |

| 11.4.1 | Product Description |

| 11.4.2 | Regulatory Milestones |

| 11.4.3 | Other Developmental Activities |

| 11.4.4 | Current Pipeline Activity |

| 11.4.4.1 | Clinical Trials Information |

| 11.4.5 | Safety and Efficacy |

| 11.5 | AFINITOR DISPERZ/VOTUBIA (everolimus): Novartis |

| 11.5.1 | Product Description |

| 11.5.2 | Regulatory Milestones |

| 11.5.3 | Other Developmental Activities |

| 11.5.4 | Safety and Efficacy |

| 11.6 | DIACOMIT (stiripentol): Biocodex |

| 11.6.1 | Product Description |

| 11.6.2 | Regulatory Milestones |

| 11.6.3 | Other Developmental Activities |

| 11.6.4 | Current Pipeline Activity |

| 11.6.4.1 | Clinical Trials Information |

| 11.6.5 | Safety and Efficacy |

| 11.7 | H.P. ACTHAR GEL: Mallinckrodt Pharmaceuticals/Questcor Pharmaceuticals |

| 11.7.1 | Product Description |

| 11.7.2 | Regulatory Milestones |

| 11.7.3 | Other Development Activities |

| 11.7.4 | Safety and Efficacy |

| 12 | Emerging Drugs |

| 12.1 | Key Competitors |

| 12.2 | Relutrigine (PRAX-562): Praxis Precision Medicines |

| 12.2.1 | Product Description |

| 12.2.2 | Other Developmental Activities |

| 12.2.3 | Clinical Development |

| 12.2.3.1 | Clinical Trials Information |

| 12.2.4 | Safety and Efficacy |

| 12.3 | Zorevunersen (STK-001): Stoke Therapeutics/Biogen |

| 12.3.1 | Product Description |

| 12.3.2 | Other Developmental Activities |

| 12.3.3 | Clinical Development |

| 12.3.3.1 | Clinical Trials Information |

| 12.3.4 | Safety and Efficacy |

| 12.4 | EPX-100 (Clemizole Hydrochloride): Harmony Biosciences |

| 12.4.1 | Product Description |

| 12.4.2 | Other Developmental Activities |

| 12.4.3 | Clinical Development |

| 12.4.3.1 | Clinical Trials Information |

| 12.5 | Bexicaserin (LP352): Lundbeck (Longboard Pharmaceuticals) |

| 12.5.1 | Product Description |

| 12.5.2 | Other Developmental Activities |

| 12.5.3 | Clinical Development |

| 12.5.3.1 | Clinical Trials Information |

| 12.5.4 | Safety and Efficacy |

| 12.6 | Carisbamate (YKP509): SK Life Science |

| 12.6.1 | Product Description |

| 12.6.2 | Other Developmental Activities |

| 12.6.3 | Clinical Development |

| 12.6.3.1 | Clinical Trials Information |

| 12.7 | Elsunersen (PRAX-222): Praxis Precision Medicines |

| 12.7.1 | Product Description |

| 12.7.2 | Clinical Development |

| 12.7.2.1 | Clinical Trials Information |

| 12.7.3 | Safety and Efficacy |

| 12.8 | Tricaprilin (CER-0001): Cerecin Neurosciences |

| 12.8.1 | Product Description |

| 12.8.2 | Other Developmental Activities |

| 12.8.3 | Clinical Development |

| 12.8.3.1 | Clinical Trials Information |

| 12.8.4 | Safety and Efficacy |

| 12.9 | ETX101: Encoded Therapeutics |

| 12.9.1 | Product Description |

| 12.9.2 | Other Developmental Activities |

| 12.9.3 | Clinical Development |

| 12.9.3.1 | Clinical Trials Information |

| 12.9.4 | Safety and Efficacy |

| List to be continued in the report | |

| 13 | DEE: The 7MM Analysis |

| 13.1 | Key Findings |

| 13.2 | Market Outlook |

| 13.3 | Conjoint Analysis |

| 13.1 | Key Market Forecast Assumptions |

| 13.1.1 | CDKL5 Deficiency Disorder |

| 13.1.2 | Dravet Syndrome |

| 13.1.3 | LGS |

| 13.1.4 | SCN8A/2A-DEE |

| 13.1.5 | West Syndrome |

| 13.1.6 | TSC |

| 13.2 | Total Market Size of DEE in the 7MM |

| 13.3 | United States Market Size |

| 13.3.1 | Total Market Size of DEE in the United States |

| 13.3.2 | Market Size of DEE by Therapies in the United States |

| 13.4 | EU4 and the UK Market Size |

| 13.4.1 | Total Market Size of DEE in EU4 and the UK |

| 13.4.2 | Market Size of DEE by Therapies in EU4 and the UK |

| 13.5 | Japan Market Size |

| 13.5.1 | Total Market Size of DEE in Japan |

| 13.5.2 | Market Size of DEE by Therapies in Japan |

| 14 | Unmet Needs |

| 15 | SWOT Analysis |

| 16 | KOL Views |

| 17 | Market Access and Reimbursement |

| 17.1 | United States |

| 17.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 17.2 | EU4 and the UK |

| 17.2.1 | Germany |

| 17.2.2 | France |

| 17.2.3 | Italy |

| 17.2.4 | Spain |

| 17.2.5 | United Kingdom |

| 17.3 | Japan |

| 17.3.1 | MHLW |

| 17.4 | Market Access and Reimbursement |

| 18 | Appendix |

| 18.1 | Bibliography |

| 18.2 | Report Methodology |

| 19 | DelveInsight Capabilities |

| 20 | Disclaimer |

| 21 | About DelveInsight |

Related Reports

Developmental and Epileptic Encephalopathies Epidemiology Forecast

Developmental and Epileptic Encephalopathies Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted DEE epidemiology in the 7MM, i.e., the United States, EU4 and the UK (Germany, France, Italy, Spain, and the United Kingdom), and Japan.

Developmental and Epileptic Encephalopathies Pipeline

Developmental and Epileptic Encephalopathies Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key DEE companies, including Denovo Biopharma, Cantex Pharmaceuticals, CNS Pharmaceuticals, CANbridge Pharmaceuticals, Vaximm, Inovio Pharmaceuticals, Mustang Bio, Bullfrog AI Holdings, Cantex, Chimeric Therapeutics, Philogen, Boehringer Ingelheim, Photonamic GmbH, Berg Pharma, Beyond Bio, Genenta Science, Polaris Pharmaceuticals, Telix Pharmaceuticals, Shanghai Simnova Biotechnology, NEONC Technologies, among others.

Epilepsy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key epilepsy companies including Xenon Pharmaceuticals, Aquestive Therapeutics, Atnahs Pharma (Pharmanovia), Takeda, Ovid Therapeutics, SK Biopharmaceuticals (SK Life Science), Eisai, Biohaven Pharmaceuticals, Knopp Biosciences, UCB Pharma, Alexza Pharmaceuticals, Neurocrine Biosciences, Idorsia Pharmaceuticals, Equilibre Biopharmaceuticals, among others.

Epilepsy Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key epilepsy companies, including UCB, SK Life Science, Stoke Therapeutics, Xenon Pharmaceuticals, Epygenix, Bright Minds Biosciences, Neurona Therapeutics, Cevevel Therapeutics, PTC Therapeutics, Addex Pharmaceuticals, Equilibre Biopharmaceuticals B.V., ES Therapeutics Australia Pty Ltd, Overseas Pharmaceuticals, Anavex Life Sciences, Eliem Therapeutics, Ovid Therapeutics, CAMP4 Therapeutics, LifeSplice, Virpax Pharmaceuticals, Neuroene Therapeutics, among others.

Partial Epilepsy Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key partial epilepsy companies including Vertex Pharmaceuticals, Supernus Pharmaceuticals, Xenon Pharmaceuticals, UCB Pharmaceuticals, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us

Shruti Thakur

info@delveinsight.com

+14699457679

www.delveinsight.com

Distribution channels: Healthcare & Pharmaceuticals Industry, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release